Foreign investors (being organizations and/or individuals) and/or foreign-invested economic organizations (as listed in Section 1 below), when engaging in transactions (including capital contribution, subscription for newly issued shares, or purchase of existing shares/capital contributions (hereinafter collectively referred to as “M&A transactions“)) in enterprises in Vietnam (“Target Entity”) and falling within at least one of the cases specified in Section 2 below, shall be required to carry out the procedure for registration of capital contribution, share or capital contributions acquisition with the competent State authority (“M&A Approval“).

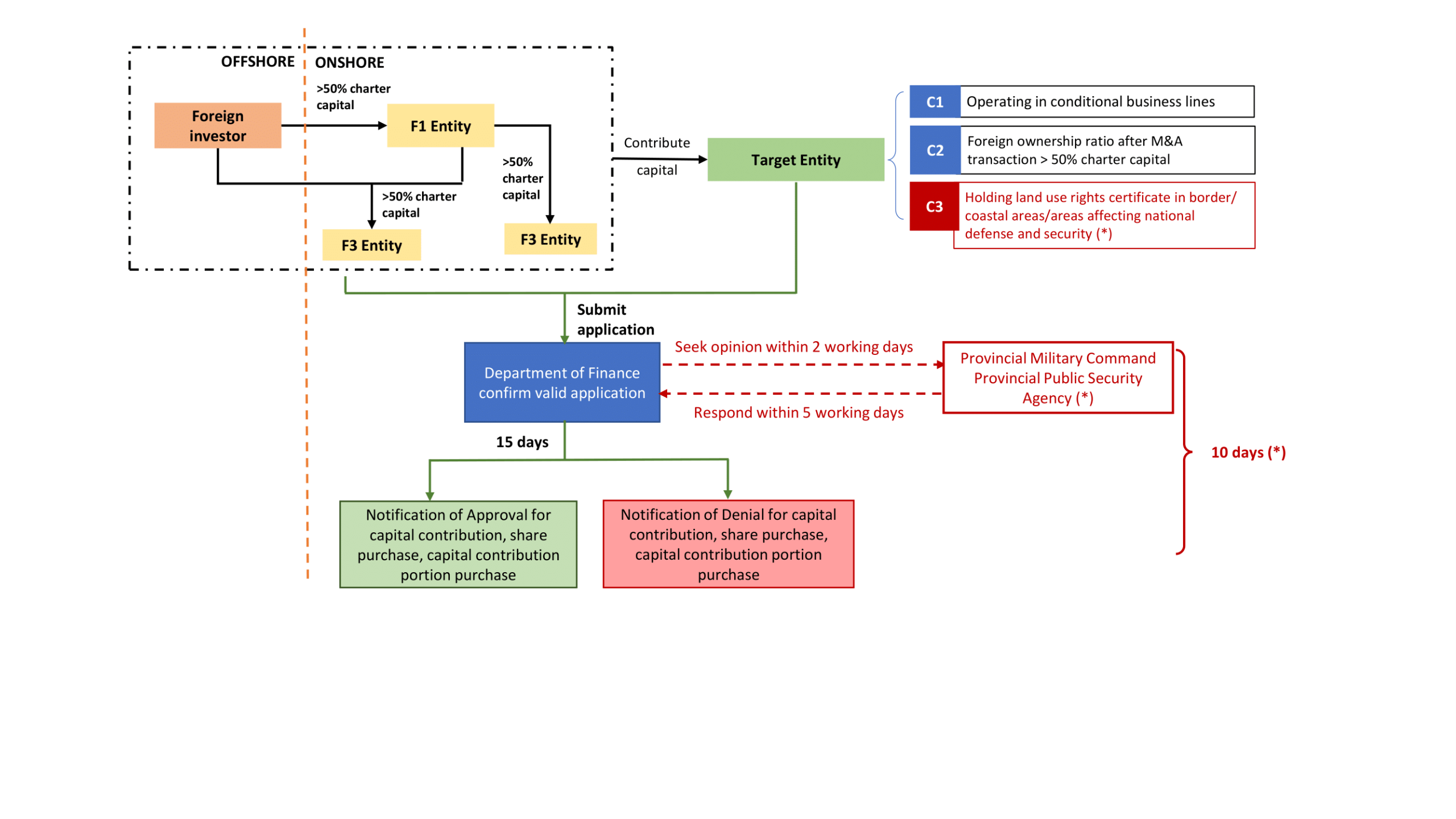

Details on the M&A Approval procedure are stipulated in Law No. 61/2020/QH14 of the National Assembly dated 17 June 2020 (“Law on Investment“) and Decree No. 31/2021/NĐ-CP of the Government dated 26 March 2021 detailing and guiding the implementation of a number of articles of the Investment Law (“Decree 31“) and are diagrammed as follows:[1][2]

1. Subjects Required To Register for M&A Approval

Pursuant to the provisions of the Law on Investment, the M&A Approval procedures apply to the following groups of subjects:[3]

a. “Foreign investor”: includes foreign individuals and organizations established under foreign laws that conduct business or investment activities in Vietnam;

b. F1 economic organization (the “F1 Entity”): includes economic organizations established in Vietnam where foreign investors hold more than 50% of the charter capital;

c. F2 economic organization (the “F2 Entity”): includes economic organizations established in Vietnam where F1 Entity hold more than 50% of the charter capital;

d. F3 economic organization (the “F3 Entity”): includes economic organizations established in Vietnam where foreign investors and F1 Entity jointly hold more than 50% of the charter capital.

(F1 Entity, F2 Entity, and F3 Entity are hereinafter collectively referred to as “foreign-invested Entity”).

2. Cases Requiring M&A Approval Registration

Not all M&A transactions by the subjects specified in Section 1 trigger the M&A Approval registration requirement. The obligation to register for M&A Approval arises only if the transaction falls into one of the following cases:[4]

a. Case 1: The M&A transaction results in an increase in the foreign-owned capital ratio in the Target Entity which conducts business in sectors/industries subject to conditional market access for foreign investors.

b. Case 2: The M&A transaction results in the foreign investors or foreign-invested Entity holding more than 50% of the charter capital of the Target Entity in the following circumstances: increasing the foreign ownership ratio[5] from 50% or less to more than 50%; or increasing the foreign ownership ratio when this ratio is already more than 50% of the charter capital.

c. Case 3: The Target Entity holds a certificate of land use rights for land located in islands and border communes, wards, or townships; coastal communes, wards, or townships; or other areas affecting national defense and security.

3. Dossier For M&A Approval Registration

Prior to executing the M&A transaction, if the foreign investor or foreign-invested Entity falls within a case requiring M&A Approval registration, such the foreign investor or foreign-invested Entity must coordinate with the Target Entity to submit the M&A Approval application dossier to the Department of Finance where the Target Entity is headquartered. The composition of the dossier includes: [6]

a. A written application for registration to carry out the M&A transaction in the form issued by the Ministry of Finance;

b. A copy of the legal documents of the individuals or organizations executing the M&A transaction and of the Target Entity;

c. The principal agreement (or heads of agreement) regarding the M&A transaction;

d. A copy of the certificate of land use rights for land located in islands, border communes, wards, or townships, and coastal communes, wards, or townships, or other areas affecting national defense and security of the Target Entity (if any).

4. Sanctions For Violating The Obligation To Carry Out The M&A Approval Registration

Decree No. 122/2021/ND-CP of the Government dated December 28, 2021 on administrative sanctions in the field of planning and investment (“Decree 122”) imposes a financial penalty ranging from VND 80 – 100 million (for organizations) or VND 40 – 50 million (for individuals) for the “act of capital contribution, share purchase, or purchase of capital contributions in an economic organization failing to meet the prescribed conditions”.[7] Accordingly, failure to carry out the M&A Approval registration where required, or proceeding with an M&A Transaction without the requisite approval, may result in the foregoing administrative sanctions.

5. Practical Application And Notes Regarding The M&A Approval Registration Procedure

a. Under the Law on Investment, the obligation to register for M&A Approval only arises when the execution of the M&A transaction alters the foreign-ownership ratio in the Target Entity. However, in practice, State authorities may still require M&A Approval registration even if there is no change in the foreign-ownership ratio of the Target Entity. For instance, if the Target Entity already has a foreign investor owning over 50% of the charter capital, and a new foreign investor acquires all or part of the capital contribution/shares from the existing foreign investor, this transaction does not change the foreign-ownership ratio. Nonetheless, the State authority may still require the M&A Approval registration if the nationality of the existing Foreign Investor differs from that of the new Foreign Investor.

b. Pursuant to Article 124.3 of Decree No. 168/2025/NĐ-CP of the Government dated June 30, 2025, and Form A.I.7 as amended and supplemented by Circular No. 25/2023/TT-BKHĐT of the Ministry of Planning and Investment (now the Ministry of Finance), which amends Circular No. 03/2021/TT-BKHĐT dated April 09, 2021, when carrying out the M&A Approval registration, the Foreign Investor and the Target Entity must declare the “actual transaction value” instead of the “expected transaction value” as previously required.

c. In case the actual transaction value at the time of completing the transaction differs from the “actual transaction value” recorded in the M&A Approval, the parties may encounter difficulties when dealing with banks or other related third parties. This is particularly true for the bank where the Direct Investment Capital Account (DICA) is opened in Vietnam (applicable when the foreign ownership ratio in the Target Entity is 51% or more). The commercial bank may refuse to process related payments if the actual payment value does not match the transaction value recorded in the M&A Approval. Meanwhile, current law does not yet provide procedures for amending or adjusting the M&A Approval, leading to difficulties for the parties in the process of completing the transaction.

d. Although current law stipulates specific time limits for each step of the M&A Approval registration procedure (as described in the diagram at the beginning of the article), the actual processing times often exceeds the statutory limits, especially when opinions from relevant ministries and sectors are required, and depends substantially on local licensing practices. Therefore, prior to proceeding with the transaction, the parties should consult on the local licensing practice to plan the execution of the transaction accordingly.

e. Furthermore, if the M&A transaction value meets the statutory threshold, the parties must also comply with the economic concentration notification procedure (or also known as merger filing) under the Law on Competition 2018. Details of this procedure are presented in our previous article: Obligation to Notify Economic Concentration in M&A Transactions.

——————

[1] Article 66 of Decree 31

[2] (*) The consultation with the Provincial Military Command and the Provincial Public Security Department shall only be carried out in cases where the Target Entities possesses a certificate of land use rights for land located in islands, border communes, wards, and townships, and coastal communes, wards, and townships; or other areas affecting national defense and security. In such cases, the time limit for the Department of Finance to issue a notice shall be 10 days from the date of receipt of the valid application dossier.

[3] Articles 3.19, 23 and 26 of the Law on Investment

[4] Article 26.2 of the Law on Investment

[5] The “foreign-ownership ratio” in this case refers to the total ownership ratio of charter capital held by foreign investors and foreign-invested economic organizations in the Target Entity upon completion of the M&A transaction.

[6] Article 66.2 of Decree 31

[7] Article 16.1 of Decree 122

Disclaimer: This article was prepared by PTN Legal LLC (“PTN Legal”) solely for the purpose of providing reference information to readers. PTN Legal does not commit or guarantee the accuracy or completeness of this information. The content of the article may be changed, adjusted, or updated without prior notice. PTN Legal is not responsible for any errors or omissions in this article or damages arising from the use of this article in any circumstance.