The year 2025 has concluded with the promulgation, amendment, and supplementation of numerous legal policies regarding taxation, which shall enter into force in 2026. In this article, we present a summary of notable regulatory adjustments within each specific tax category.

For the convenience of our readers, this article is structured into two parts: (i) key highlights generalized through illustrative visuals in the first section ; and (ii) specific content presented in detail in the subsequent section. Detailed changes and adjustments for each specific tax category will continue to be updated in our upcoming publications.

- License fees

From 1 January 2026, Licensing Fee shall be officially abolished pursuant to Resolution No. 198/2025/QH15 of the National Assembly dated 17 May 2025.

Personal income tax (PIT)

Law No. 109/2025/QH15 of the National Assembly dated 10 December 2025 shall take effect from 01 July 2026; regulations related to income from business, salaries, and allowances of resident individuals shall apply from the tax period of 2026.

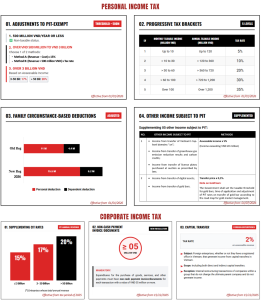

a. Adjustments to the PIT-exempt revenue threshold

Accordingly, from 1 January 2026, the revenue ceiling for non-taxable status regarding resident individuals with business income is adjusted from VND 200 million/year to VND 500 million/year.

b. Adjustment of Calculation Methods for PIT on income from business operations

Resident individuals earning business income with an annual revenue from over VND 500 million to VND 3 billion may choose to pay tax according to one of the two following methods:

Determining payable PIT equal to taxable income (revenue from sale of goods, services minus (-) expenses related to production,business activities during the tax period) multiplied (x) by the tax rate (15%); or

Determining payable PIT equal to taxable revenue (revenue exceeding VND 500 million) multiplied (x) by the tax rate (corresponding to the business sector).

Resident individuals earning business income with an annual revenue exceeding VND 03 billion shall pay tax based on the method determining payable PIT equal to assessable income multiplied (x) by the tax rate:

17%: If annual revenue is from over VND 03 billion to VND 50 billion.

20%: If annual revenue exceeds VND 50 billion.

Note: For individuals leasing real estate, excluding accommodation business activities, PIT is determined by the revenue portion exceeding VND 500 million multiplied (x) by a tax rate of 5%.

c. Adjustment of the progressive tax brackets

- Reduction of tax brackets from 7 levels to 5 levels.

- Raising the income threshold within each bracket to ensure rationality and encourage labor.

Tax bracket | Annual taxable income (million VND) | Monthly taxable income (million VND) | Tax rate (%) |

1 | Up to 120 | Up to 10 | 5 |

2 | Exceeding 120 but not exceeding 360 | Exceeding 10 but not exceeding 30 | 10 |

3 | Exceeding 360 but not exceeding 720 | Exceeding 30 but not exceeding 60 | 20 |

4 | Exceeding 720 but not exceeding 1.200 | Exceeding 60 but not exceeding 100 | 30 |

5 | Over 1.200 | Over 100 | 35 |

d. Adjustment of family circumstance-based deductions

Personal deduction: 15.5 million VND per month (previous regulation was VND 11 million/month);

Dependent deduction: 6.2 million VND per dependent per month (previous regulation was VND 4.4 million/month).

e. Supplementing 05 other income subject to PIT

NO. | OTHER INCOME SUBJECT TO PIT | METHODS |

1 | Income from transfer of Vietnam’s top-level domains “.vn”; | Determined by multiplying the assessable income by the tax rate of 5%, where assessable income is the portion of income exceeding VND 20 million received by the taxpayer in each instance |

2 | Income from transfer of greenhouse gas emission reduction results and carbon credits; | |

3 | Income from transfer of license plates purchased at auction as prescribed by law; | |

4 | Income from transfer of digital assets; | Determined by multiplying the transfer price by the tax rate of 0,1%. The Government shall set the taxable threshold for gold bars, time of application and adjustment of PIT rates on transfer of gold bar according to the road map for gold market management. |

5 | Income from transfer of gold bars. |

Corporate income tax (CIT)

Law No. 67/2025/QH15 of the National Assembly dated 14 June 2025, shall take effect from 1 October 2025, and applies from the CIT tax period of 2025.

a. Supplementing CIT Rates

In addition to the standard tax rate of 20% under current regulations, new tax rates are supplemented as follows:

- A tax rate of 15% shall apply to enterprises whose total annual revenue does not exceed VND 3 billion.

- A tax rate of 17% shall apply to enterprises whose total annual revenue is from over VND 3 billion to VND 50 billion.

Note: The aforementioned tax rates of 15% and 17% do not apply to enterprises that are subsidiaries or companies in a related-party relationship where the related enterprise does not meet the conditions to apply the 15% and 17% tax rates.

b. Supplementing regulations on non-cash payments for expenditures exceeding VND 5 million

Accordingly, one of the conditions for expenses to be deductible when determining taxable income is that expenditures for the purchase of goods, services, and other payments must have non-cash payment invoice/documents for each transaction with a value exceeding VND 05 million. Non-cash payment invoice/documents shall comply with the regulations of legal documents on VAT.

This regulation applies from 15 December 2025.

c. Supplementing tax obligations of foreign enterprises transferring capital in Vietnam

Accordingly, foreign enterprises, whether or not they have a permanent establishment in Vietnam, that generate income from capital transfers in Vietnam—including both direct and indirect capital transfers, regardless of the location where the transfer occurs—have the obligation to pay CIT in Vietnam at the rate of 2% on assessable revenue arising in Vietnam. Exception: Internal restructuring transactions of companies within a group that do not change the ultimate parent company of the participating parties possessing direct or indirect ownership of the enterprise in Vietnam post-restructuring and do not generate income.

This regulation applies from 15 December 2025.

d. Regarding the effective date of regulations

On 15 December 2025, the Government issued Decree No. 320/2025/ND-CP detailing several articles and measures for organizing and guiding the implementation of the Law on CIT. The Decree takes effect from the date of signing and applies from the 2025 CIT tax period, and provides as follows:

Enterprises may choose to apply regulations on revenue, expenses, tax incentives, tax exemptions, tax reductions, and loss carry-forwards under this Decree from the beginning of the tax period of 2025, or from the date the Law on CIT takes effect, or from the date this Decree takes effect. In cases where an enterprise’s 2025 tax period begins after the effective date of the Law on CIT, such provisions shall apply from the effective date of the Law on CIT or from the effective date of this Decree;

Regulations on non-cash payment vouchers for deductible expenses and regulations on capital transfers by foreign enterprises in Vietnam apply from the effective date of this Decree, 15 December 2025.

- Value added tax (VAT)

Law No. 48/2024/QH15 dated November 26, 2024 on Value-added Tax, takes effect from 1 July 2025 (except for regulations on revenue levels of production/business households and individuals subject to non-taxable status, which take effect from 1 January 2026). This Law was amended and supplemented by Law No. 149/2025/QH15, passed on 11 December 2025, effective from 1 January 2026.

To guide the implementation of the new Law on VAT, the Government issued Decree No. 181/2025/ND-CP dated 1 July 2025 (effective 1 July 2025) and Decree No. 359/2025/ND-CP dated 31 December 2025 (amending Decree 181/2025/ND-CP, effective 1 January 2026).

a. Adjustment of revenue threshold for non-taxable VAT objects

Goods and services of production/business households and individuals with an annual revenue of VND 500 million or less are objects not subject to VAT.

This regulation applies from 1 January 2026, synchronizing with Personal Income Tax. Previously, under the new Law on VAT, this revenue level was adjusted from VND 100 million to VND 200 million, but this was never implemented in practice and has now been adjusted to VND 500 million.

b. Adjustment of taxable prices for real estate business

Specifically, taxable prices real estate business are selling prices for real estate exclusive of VAT, excluding land levies or land rents payable to state budget (deductible land prices). Deductible land prices for calculation of VAT shall be determined in some cases as follows:

In case the State allocate land or leases out land and collects lump sum rent for the entire lease term (with or without auction) the deductible land price shall be the land levies, lump sum land rents ((including compensation for land clearance advanced by land users (if any)), replacing the previous regulation which specified the winning bid price for land use rights, land rents payable to the State budget under the laws on collection of land rents and water surface rents, and compensation and land clearance costs.

In case of receiving a transfer of real estate which is land use rights from organizations or individuals, the deductible land price shall be the land levies or land rents paid to the State budget for the transferred land plot or parcel, excluding the value of infrastructure, or the transfer price excluding VAT; replacing the previous regulation which specified the land price at the time of receiving the transfer of land use rights excluding the value of infrastructure or the land price prescribed by the People’s Committee at the time of signing the transfer contract.

c. Adjustment of value of goods/services purchased shall have proofs of cashless payment

- Accordingly, one of the conditions for an enterprise to deduct input VAT is that the enterprise must possess non-cash payment vouchers for purchased goods and services (including imported goods) valued at VND 05 million or more inclusive of VAT (previously, this condition applied to purchases valued at VND 20 million or more).

- This regulation applies from 1 July 2025.

d. Adjustment of regulations on requirements for vat refund

- Under the new Law on VAT (effective 1 July 2025), a requirement for VAT refund was that the seller must have declared and paid VAT regarding the invoices issued to the enterprise requesting the refund. However, in the amended Law on VAT passed on 11 December 2025, the National Assembly officially abolished the above regulation.

- Enterprises eligible for tax refund that submitted VAT refund dossiers and had them accepted by the tax authority before 1 January 2026, but for whom the tax authority has not yet issued a Refund Decision, are not required to meet the condition that the seller must have declared and paid VAT for the invoices issued.

- Excise tax

Law No. 66/2025/QH15 of the National Assembly dated 14 June 2025, takes effect from 1 January 2026.

On 31 December 2025, the Government issued Decree No. 360/2025/ND-CP detailing the implementation of a number of articles of the Law on Excise tax, which takes effect from 1 January 2026. On the same date, 31 December 2025, the Ministry of Finance also issued Circular No. 158/2025/TT-BTC providing detailed guidance on certain provisions of Decree No. 360/2025/ND-CP, which takes effect from 1 January 2026..

a. Supplementing excise tax’s taxable objects for beverages

For the first time, “Beverages under the Vietnamese National Technical Standards (TCVN) with a sugar content exceeding 5g/100mL” are included as excise tax’s taxable objects, with the following tax rate roadmap:

From 1 January 2027: 8%

From 1 January 2028: 10%

b. Supplementing specific tax calculation

- For the first time, the Law on Excise tax prescribes two tax based and calculation methods: percentage-based method (as previously applied), based on taxable price and tax rate; and specific (absolute) tax method, based on the quantity of taxable goods and a fixed tax amount. Excise tax payable equals the total excise tax calculated under the percentage-based method plus the excise tax calculated under the specific tax method (if any).

- According to Law on Excise, from January 1, 2027, tobacco products (including cigarettes, cigars and tobacco raw materials, pipe tobacco, or other forms) shall apply both tax calculation methods to determine the payable excise tax.

- Law on Tax administration

Law on Tax Administration No. 108/2025/QH15 of the Natioanl Assembly passed on 10 December 2025, which take effect from 01 July 2026, except for regulations on tax declaration, calculation, deduction, and use of electronic invoices by business households/individuals, which take effect from 1 January 2026.

a. Adjustment to the deadline for submitting tax dossier supplementation

Under the provisions of the new Law on Tax Administration, taxpayers who discover errors or omissions in tax dossiers already submitted to the tax authority are permitted to file supplementary declarations within a period of 05 years (instead of 10 years as previously prescribed) from the expiration date of the deadline for submission of the tax dossier for the tax period containing such errors or omissions.

Concurrently, the Law supplements regulations on cases where supplementary tax declarations are not permitted upon the request of investigation agencies to serve case investigations.

b. Cases requiring fulfillment of tax liability upon taxpayer’s exit

In addition to previously prescribed cases, the new Law on Tax Administration adds cases where individuals who are beneficial owners of enterprises subject to enforcement of administrative decisions on tax management and have not completed tax payment obligations, and individuals who are beneficial owners of enterprises no longer operating at the registered address and have not completed tax payment obligations, shall fall under the category of subjects required to fulfill tax obligations before exiting the country.

The National Assembly assigns the Government to prescribe the tax debt amount and the overdue period thresholds for applying temporary exit suspension measures in accordance with the laws on exit and entry.

Currently, the thresholds for applying temporary exit suspension measures are implemented pursuant to Decree No. 49/2025/ND-CP dated 28 February 2025 of the Government, corresponding to the following cases:

No. | Case of Application | Applicable thresholds |

1 | Individual businesses, owners of household businesses who are subject to enforcement of administrative decisions on tax administration | have a tax debt of VND 50 million or more, and such tax debt have been overdue for more than 120 days. |

2 | Individuals who are legal representatives of enterprises subject to enforcement of administrative decisions on tax administration | have a tax debt of VND 500 million or more, and such tax debt have been overdue for more than 120 days. |

3 | Individual businesses, owners of household businesses, individuals who are legal representatives of enterprises, cooperatives or cooperative unions no longer operating at the registered address | have overdue tax debts in accordance with regulations, and fail to fulfill their tax obligations after 30 days from the receipt of the tax authority’s notice of exit ban. |

4 | Vietnamese citizens exiting Vietnam to reside abroad, Vietnamese people residing abroad, and foreigners who wish to exit Vietnam | have overdue tax debts, and and fail to fulfill their tax obligations. |

This article was prepared by Từ Thị Thanh Hà (Counsel) and Đào Thị Hương Ly (Paralegal).

Disclaimer of Liability: This article was prepared by PTN Legal LLC (“PTN Legal”) solely for the purpose of providing reference information to readers. PTN Legal does not commit or guarantee the accuracy or completeness of this information. The content of the article may be changed, adjusted, or updated without prior notice. PTN Legal is not responsible for any errors or omissions in this article or damages arising from the use of this article in any circumstance.